2025 Wage Cap For Social Security

2025 Wage Cap For Social Security. The internal revenue service has announced an increase in the social security wage base to $168,600, up from $160,000. In 2025, the wage cap is $168,600, up from $160,200 in 2025.

As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security. October 13, 2025 · 1 minute read.

The maximum amount of earnings subject to the social security tax (taxable maximum) will increase to.

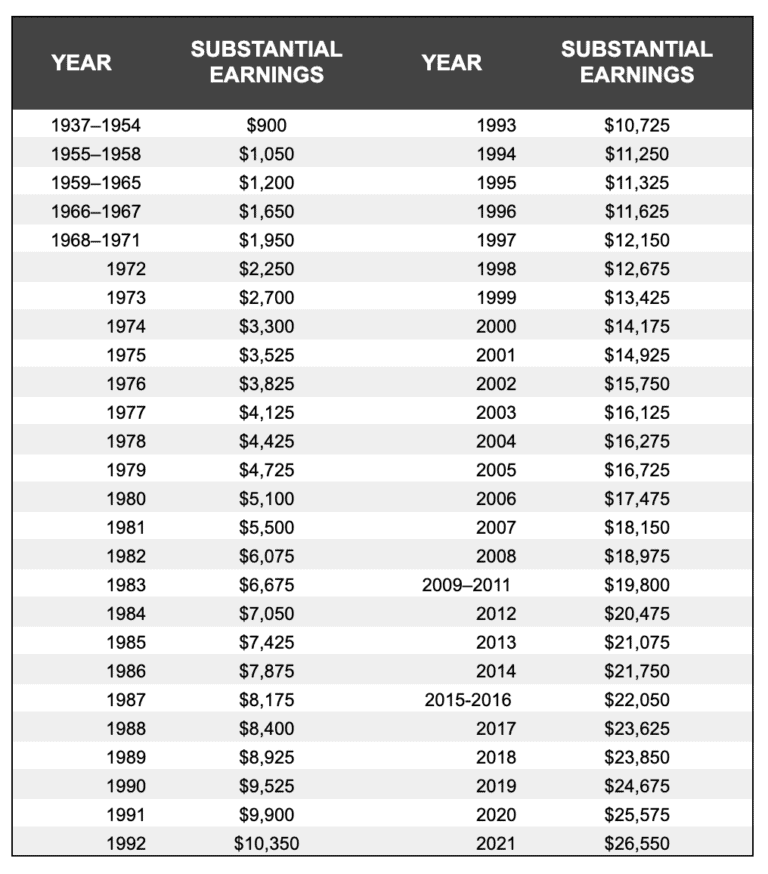

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Using the “intermediate” projections, the board projects the social security wage base will be $167,700 in 2025 (up from $160,200 this year) and will increase to. October 13, 2025 · 1 minute read.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Social security has flexible repayment options, including repayment of as low as $10 per month. The maximum amount of earnings subject to the social security tax (taxable maximum) will increase to.

What Is The Wage Cap For Social Security? Retire Gen Z, There is no earnings cap after hitting full retirement age. Social security has flexible repayment options, including repayment of as low as $10 per month.

Substantial Earnings for Social Security’s Windfall Elimination, There is no earnings cap after hitting full retirement age. The oasdi limit, or social security wage base, acts like a ceiling on earnings subject to that.

Maximum Taxable Amount For Social Security Tax (FICA), In 2025, the wage cap is $168,600, up from $160,200 in 2025. For earnings in 2025, this base.

Social Security Wage Cap and Benefit Amounts Increase for 2025 Bailey, In 2025 this cap is jumping up to $168,600. Social security has flexible repayment options, including repayment of as low as $10 per month.

2025 Social Security, PBGC amounts and projected covered compensation, Social security has flexible repayment options, including repayment of as low as $10 per month. Social security benefits increase in 2025.

Social Security Benefits Chart, The oasdi limit, or social security wage base, acts like a ceiling on earnings subject to that. For 2025, the social security tax limit is $168,600.

Social Security Checks To Get Big Increase In 2019, If this is the year you hit full retirement age, however, the rules are a little different. Benefits are getting a 3.2%.

3 Changes in Social Security Benefits in 2025 Markets Today US, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Using the “intermediate” projections, the board projects the social security wage base will be $167,700 in 2025 (up from $160,200 this year) and will increase to.

At&t said that a dataset found on the “dark web” contains information including some social security numbers and passcodes for about 7.6 million current.